Drayage RFQs 2025: Pricing Strategies & Procurement Tactics Explained

Drayage RFQs aren’t just about price. Learn how ocean carriers run bids, procurement’s real priorities, and strategies to win profitable contracts in 2025.

How Ocean Carrier Drayage RFQs Actually Work in 2025

What’s Happening

With 40+ years of experience in drayage RFQs, pricing, procurement, and negotiations, we’ve seen how ocean carriers really run RFQs—and it’s not what most drayage carriers expect.

Ask an ocean carrier’s procurement team what matters most in a drayage RFQ, and they’ll tell you two things: price and service.

On the surface, this seems straightforward. In reality, ocean carrier RFQs are about cost first, with service acting as a pass/fail filter—either you meet the service standard, or you don’t. If you do, you’re in the running. If not, you’re out. Once that hurdle is cleared, price becomes the single biggest deciding factor.

But that’s not the only game at play. Here’s what most drayage carriers don’t realize:

- You might be included with zero chance of winning. Some carriers are invited only to drive down rates—procurement already knows who will be awarded business.

- Incumbents have a major advantage. If you’re new to the RFQ, you’re likely being used as a pricing benchmark rather than a serious contender.

- The process is messy. Internal politics between procurement and operations influence decisions in ways that aren’t always rational.

- The data is unreliable. RFQs are full of assumptions—volumes shift, accessorials vary, and there’s no universal way to compare service quality.

- Nobody really knows next year’s volume. Procurement is making an educated guess, and it’s often wrong.

- Relationships do matter. They may not win you the business, but they can get you more information, more opportunities, and even second chances. You need to build these relationships before the RFQ.

Why It Matters

Even before an RFQ is sent out, decisions are already being shaped by forces carriers don’t see. The process may look like a structured cost analysis, but it’s heavily influenced by internal politics, data inconsistencies, and pre-set pricing expectations.

How to Respond

- Recognize that most RFQs aren’t won on price alone, but price is the biggest factor.

- Identify when you’re being used to drive down rates and avoid wasting time on non-opportunities.

- Winning in 2025 means understanding the process—knowing how procurement actually operates, not just submitting a bid.

💡 Key takeaway: Winning an RFQ isn’t just about price—it’s about knowing when you’re a real contender and when you’re just a pricing benchmark.

RFQ Pricing Tactics: How Ocean Carriers Push Drayage Rates Down

What’s Happening

Not all ocean carriers follow the same RFQ process. Some have structured procurement strategies, like the Six Sourcing Steps, while others rely on custom workflows, internal relationships, or past pricing trends.

Regardless of the approach, RFQs follow a similar structure:

1. Collecting Market Data: What’s Happening in the Market?

RFQs exist to build a dataset of current pricing—but how that data is used depends on the scope of the RFQ.

- National-Level RFQs → Broad in scope and highly competitive. Large carriers often offer small lane-level reductions or volume incentives to drive down unit costs across multiple regions. These events can be multi-step, delayed, and often suffer from lower data quality.

- Regional or Local RFQs → More operationally focused with better data. However, favoritism toward incumbents is common, and operations teams have more influence in awarding business.

💡 Key takeaway: In national RFQs, you're competing with large carriers offering broad cost reductions. In regional RFQs, service history and relationships carry more weight—but favoritism plays a role.

2. Carrier Invitations: Who Gets Invited?

When an ocean carrier launches an RFQ, they invite a mix of providers to ensure competitive pricing. However, not all participants have a real shot at winning.

- Incumbent providers → The safest bet for procurement. They know the business and often have the best chances of winning.

- Benchmark bidders → New carriers invited mainly to create pricing pressure, not necessarily to win business.

💡 Key takeaway: Some RFQs are not true opportunities. If you’re being used as a pricing benchmark, your bid won’t translate into real business.

3. Bid Collection & Review: What Are the Numbers?

Once responses are in, procurement teams analyze bids to see where they can cut costs.

- If rates come in lower than expected, they move toward awarding business to the most cost-effective carriers. They look for “price compression”—bids clustering in a narrow range, confirming true market rates.

- If rates seem too high, procurement may:

- Cancel the bid and keep existing providers.

- Restructure lane groupings to lower total costs.

💡 Key takeaway: RFQs don’t always lead to new business. If procurement doesn’t see the cost reductions they expect, they may cancel the RFQ or renegotiate terms.

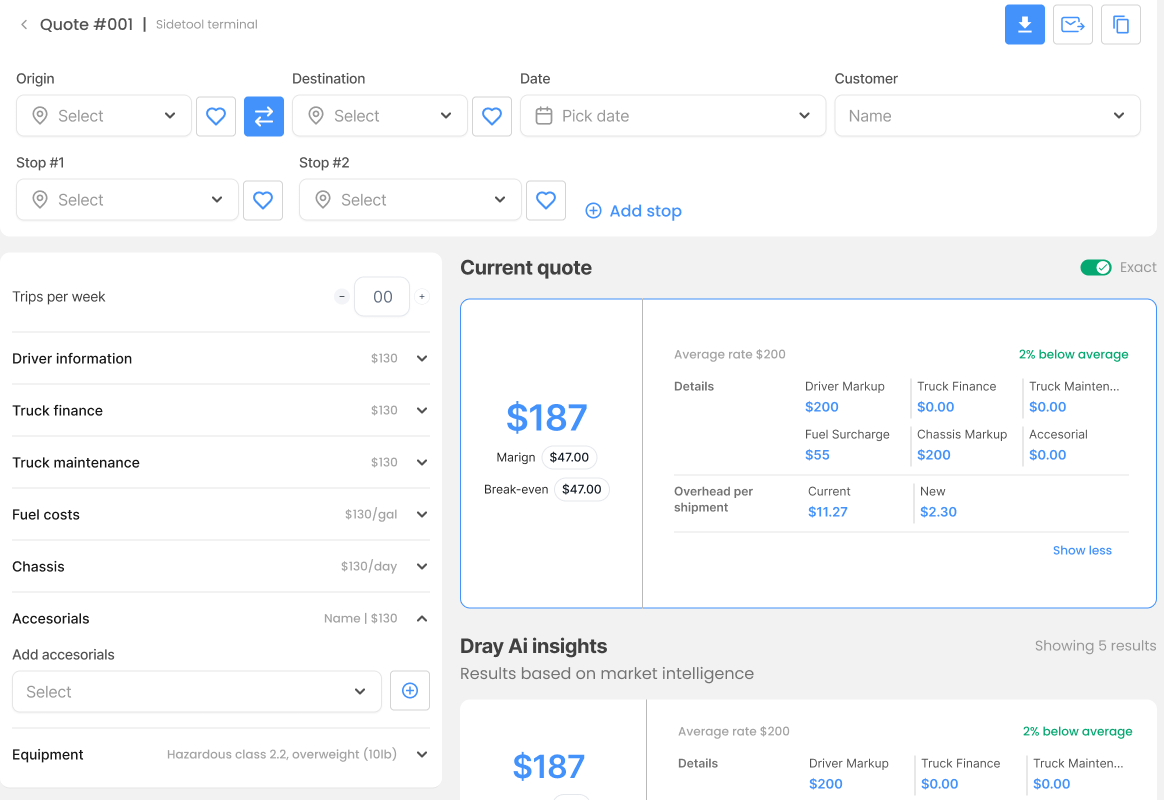

Quote smarter, faster and better with Dray Insight's Quoting Tool. Users benefit from centralized quotes enabling teams to respond to customer with speed and profitability in every load.

How to Price Drayage Bids & Avoid Procurement Pitfalls

What’s Happening

Understanding how RFQs are structured is one thing, but knowing how to price your bids profitably is another challenge altogether. Before you even think about responding to an RFQ, you need to ensure you can price your bid profitably. Ocean carriers will always prioritize cost, and without a clear understanding of your break-even rates, you could be bidding yourself into a money-losing contract.

- Bidding too low and locking themselves into unprofitable lanes.

- Bidding too high and pricing themselves out of the market.

- Misunderstanding the impact of volume, lane mix, and operational requirements.

Why It Matters

Winning an RFQ doesn’t mean much if it doesn’t make you money. Without a strong grasp of costs and market conditions, carriers can end up in contracts that hurt their bottom line. Remember that RFQs are heavily cost focused, i.e. they will naturally lower rates or compress carriers into the lowest rate band available in the market.

How to Respond

- Know Your Costs Before You Bid

- Even if you use point-to-point rates, you must understand your cost per mile, cost per hour, and overhead.

- Consider external factors like terminal wait times, customer payment behavior, and seasonal fluctuations in driver pay.

- Know Your Market So You Don’t Undervalue Yourself

- Market pricing isn’t just about what you charge—it’s about what competitors charge and what shippers are willing to pay.

- Look at demand trends and recent market shifts before setting your rates.

- Costs and Pricing Are Separate Discussions

- Your costs tell you where to walk away. The market dictates what you can charge.

- In drayage, differentiating service levels can be difficult, especially with large organizations that prioritize cost over quality.

💡 Key takeaway: If you don’t know your costs and the market, you’re either leaving money on the table or locking yourself into bad rates.

The #1 Drayage RFQ Mistake: Ignoring Hidden Accessorial Costs

What’s Happening

There’s a common military phrase: “The map is not the terrain.” The same applies to RFQs.

RFQs often contain flawed or misleading data, making it easy to submit a bid that looks good on paper but is unprofitable in reality. The issue isn’t just bad data—it’s that procurement teams rely on massive amounts of raw information from internal systems, making it difficult to translate into an accurate and usable RFQ format.

Why It Matters

RFQs often present an idealized version of operations that doesn’t reflect real-world conditions. If you assume RFQ data is completely accurate, you risk:

- Underpricing lanes due to inflated volume estimates. What looks like a high-volume opportunity on paper may shrink in reality, leaving you with lower revenue than expected.

- Missing hidden costs from overlooked accessorial charges, wait times, chassis splits, and other operational nuances that procurement may not factor in.

- Bidding with unrealistic assumptions that don’t align with actual market conditions, leading to unprofitable contract commitments.

Accessorials Are the Hidden Cost Sink

Many RFQs ignore or underestimate accessorial charges like detention, chassis splits, and storage fees. This isn’t always intentional—procurement teams may lack full visibility into accessorial costs or assume they are already included in carrier pricing.

To protect your margins:

- If accessorials are included, compare them against the ocean carrier’s expected reimbursements to ensure your costs are covered.

- If accessorials are missing, assume procurement expects you to absorb those costs unless explicitly negotiated.

- Check how claims must be submitted—some carriers require pre-approvals, paper receipts, J1 documentation, or rigid timelines that make reimbursement difficult.

💡 Key takeaway: RFQs rarely account for all the operational costs you’ll face. Before bidding, challenge volume estimates, clarify accessorial terms, and ensure your bid reflects real-world conditions.

How to Respond

Volume Forecasting Is a Guess

- Ocean carriers don’t have perfect visibility into future demand.

- Procurement isn’t trying to mislead you—forecasting in ocean logistics is notoriously inaccurate.

- If procurement is claiming a 20% increase in volume from last year but nothing in the market suggests that, it’s a red flag.

- You might win a lane expecting 500 moves per month but only get 200.

💡 Key takeaway: Assume RFQ volume is an estimate. Lanes with higher volume will have better estimates than low-volume lanes.

RFQs Aim for Fair Comparisons, But Not All Rates Are Equal

- Procurement teams use RFQs to standardize carrier pricing for fair comparisons, but not all rates are structured the same way.

- After rates are collected, internal weightings are applied based on service history, operational fit, and performance.

- Even if two carriers submit the same rate, one may be perceived as more expensive after procurement applies these adjustments.

💡 Key takeaway: RFQs don’t just compare rates—they compare total cost of ownership. If you have a relationship with the procurement team, ask how they will compare rates and carriers so your bid is competitive beyond purely price.

The Internal Battle: Who Actually Decides Which Carriers Win?

What’s Happening

Carrier selection isn’t just about price—it’s shaped by an internal negotiation between procurement and operations.

- Both care about cost and service, but they struggle to balance the two due to poor service data.

- In the absence of strong service data, price usually wins.

Why It Matters

Winning an RFQ isn’t just about offering the lowest price—it’s about understanding who actually influences the final decision.

How to Respond

Procurement: Balancing Cost and Service with Limited Visibility

- Priority: Reducing drayage costs while maintaining acceptable service.

- How they evaluate bids: Price is the main factor, but service is a pass/fail decision rather than a ranked metric.

- Biggest challenge: Service is hard to quantify, making it difficult to compare carriers beyond price.

💡 Key takeaway: Procurement wants reliable service but lacks consistent data to measure it. Since service is hard to score, decisions default to cost-driven comparisons unless operations raises concerns.

Operations: Managing Real-World Service and Hidden Costs

- Priority: Ensuring cargo moves without disruption while keeping costs under control.

- How they evaluate bids: Weighs past service performance against rate savings.

- Biggest challenge: Operations knows that low-cost carriers often have higher accessorials, storage fees, and penalties, but struggles to prove it with data.

💡 Key takeaway: Operations understands that bad service creates hidden costs, but those costs often don’t show up in procurement’s financial models. Their pushback matters most in regional RFQs, where local relationships and execution are critical.

Common RFQ Tactics: How Procurement Strategies Impact Dray Rates

Once bids are submitted, ocean carriers use various tactics to drive rates lower and optimize their networks. Understanding these strategies helps avoid unnecessary price cuts and prevents getting locked into unsustainable bids.

1. Target Rates: The Invisible Ceiling (and the Spaghetti Method)

Before an RFQ is even issued, procurement often sets pricing targets based on past rates and internal market intelligence. Sometimes, these targets are what’s known as ‘spaghetti rates’—arbitrary discounts thrown at the wall just to see what sticks.

- If your price is too high, you’re out.

- If your price is too low, you may be leaving money on the table.

These target rates act as an invisible ceiling—if procurement has already set an expectation for a 5% cost reduction, any bid above that might be dismissed outright, no matter your service quality.

💡Key takeaway: Procurement’s “target rates” aren’t always based on real cost factors—they’re often designed to pressure carriers into lower bids.

2. Live Auctions: Pushing Bids Lower

Some RFQs invite carriers to re-bid in real time against competitors. This is designed to create a race to the bottom, where carriers feel pressured to keep cutting rates just to stay competitive.

But here’s the catch:

- Winning a live auction doesn’t guarantee volume.

- It only guarantees you’ve agreed to a lower rate.

In many cases, procurement will use the lowest bid to negotiate down other providers, meaning you may still lose the lane while driving down the entire market rate.

💡Key takeaway: If you’re participating in a live auction, set a floor price in advance. When you hit your walk-away point, walk away!

3. Lane Bundling: Trading Discounts for Volume—But Watch for Loss Leaders

Ocean carriers frequently package profitable and unprofitable lanes together to lower their network costs.

- Large carriers can absorb unprofitable lanes because they spread the cost across a high volume of freight.

- Smaller carriers must be careful—if volume assumptions are wrong, they could end up running only the money-losing lanes while the profitable ones never materialize.

Carriers often accept loss leaders (unprofitable lanes) expecting volume to balance them out—but if that volume never comes, they’re stuck.

💡 Key takeaway: If you take on a loss leader, be sure you can absorb the loss—or you may end up with only the bad lanes and none of the profitable ones. If you’re a small to mid-sized carrier, loss leaders are a gamble you can’t afford. Without guaranteed volume, you could end up servicing only the worst lanes.

Conclusion: Winning in 2025 Means Playing the Real Game

What’s Happening

The ongoing freight market downturn shows no structural signs of relief. Spot rates remain weak, capacity is still outpacing demand, and even contract freight is seeing downward pressure. On top of that, new tariffs could create additional cost volatility, forcing shippers to reassess their supply chains and potentially driving procurement teams to squeeze drayage rates even further.

In short: Margins are shrinking, and RFQs will still be challenged in 2025.

Why It Matters

With procurement teams already favoring cost over service, carriers that don’t price correctly in annual bids risk locking themselves into unprofitable shipments for an entire contract cycle. If you’re not careful, a bad RFQ bid could leave you running lanes at a loss while fuel, labor, and accessorial costs continue to climb.

How to Respond

- Be ruthless about your walkaway points → If you can’t move a shipment profitably, don’t bid just to “win.” Winning at a loss is worse than not winning at all.

- Price with inflation and tariffs in mind → If geopolitical factors or new cost pressures emerge, you need to bake that risk into your pricing upfront.

- Use data to justify pricing → The best leverage against a rate squeeze is evidence. If a lane has excessive wait times, fuel inefficiencies, or higher-than-average accessorials, document it and present it to procurement before bidding.

- Strengthen relationships with operations teams → If procurement is focused on costs, operations teams are your best advocates for service quality. If they trust you to execute better than a cheaper alternative, their pushback could help you keep or win lanes.

💡 Key takeaway: 2025 is shaping up to be an even tougher RFQ cycle, with downward pricing pressure, weak market fundamentals, and tariff-related cost risks. The carriers that survive will be the ones that price smarter, walk away from bad bids, and use data to defend their margins.