The Drayage Dispatch: January 17 - 23, 2025

Drayage & Intermodal Weekly Update Trade policy and network design are colliding in ways that are showing up in lane

Trade policy uncertainty is showing up in operational decisions, from inventory timing to equipment buying. On December 18, the Port of Los Angeles reported November volume of 782,249 TEUs, down 12% year over year after earlier frontloading, even as it projected finishing 2025 above 10 million TEUs. Long-horizon infrastructure bets continued on the East Coast, with the Port Authority of New York and New Jersey approving a 33-year lease extension at Maher Terminals through September 2063. Meanwhile, regulatory signals around autonomy and a steep slowdown in Class 8 retail sales point to an industry trying to keep optionality without committing too early.

Union Pacific and Norfolk Southern filed an application with the Surface Transportation Board seeking approval to combine the two railroads. The companies said their nearly 7,000-page filing details how the merger would convert 10,000 interline lanes to single-line service and reduce an estimated 2,400 rail car and container handlings per day. Progressive Railroading.

The Port Authority of New York and New Jersey approved a 33-year lease extension at Maher Terminals that would secure operations through September 2063. The agreement includes Maher taking full responsibility by 2030 for maintaining and rehabilitating wharf and berth structures within its leasehold, alongside rent incentives tied to capacity growth. The Maritime Executive.

A CNBC report described tariffs reshaping how supply chains stock up for the holidays, and the Port of Los Angeles provided a real-time snapshot of what that volatility looks like at the gate. Port leadership said it still expects to finish 2025 above 10 million TEUs, despite year-over-year softness tied to earlier frontloading. FreightWaves. CNBC.

Implication: Drayage planning gets harder when volume moves shift from steady seasonal patterns to policy-driven surges and air pockets.

U.S. Class 8 retail truck sales fell sharply in November, extending a multi-month downtrend and signaling restrained fleet replacement and expansion. The article described the decline both versus last year and sequentially from October. Transport Topics.

Implication: Softer new-truck demand can translate into tighter capacity investment, affecting drayage service levels and pricing leverage in 2026.

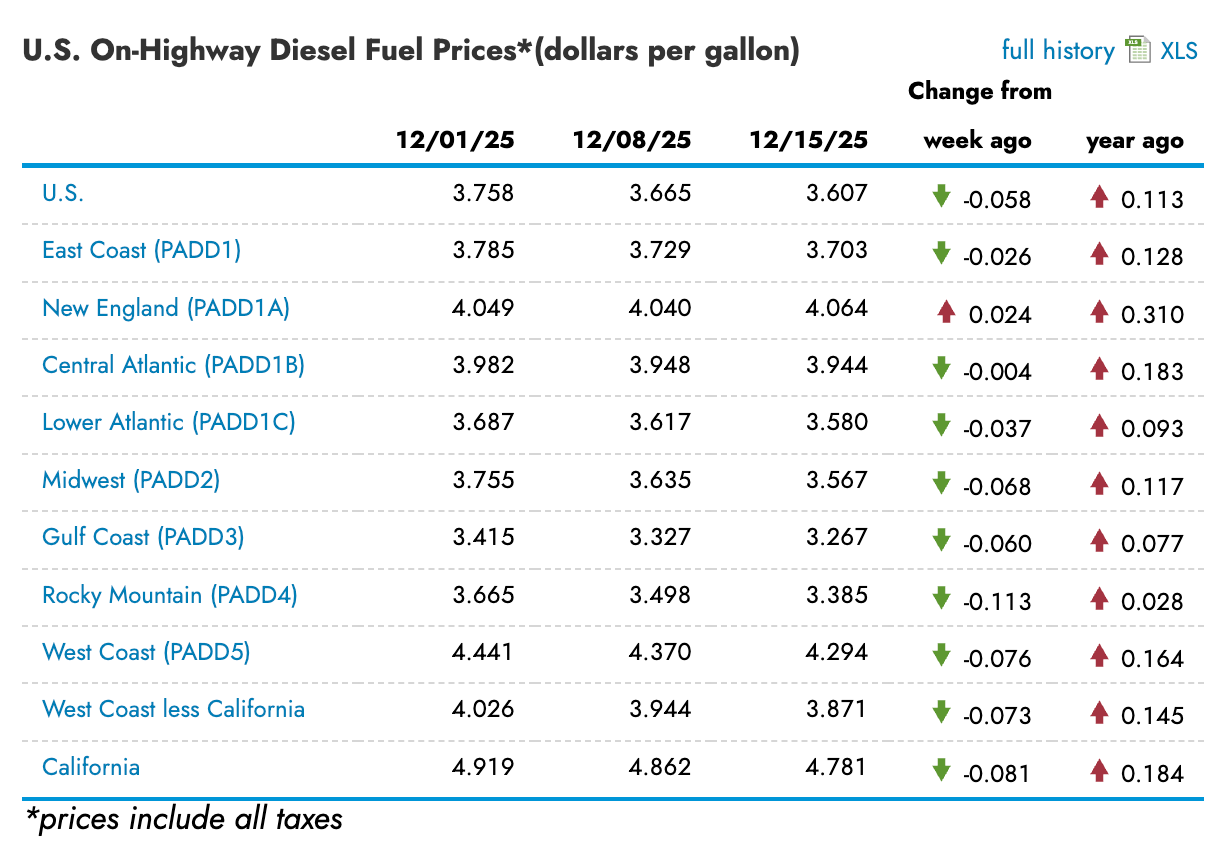

Source: EIA Gasoline and Diesel Fuel Update

California’s DMV is signaling momentum toward allowing heavy-duty autonomous truck testing and deployment. The state opened a 15-day public comment period on revised rules, which a former FMCSA official interpreted as a sign the agency is ready to proceed. The DMV said it expects to complete rulemaking by the end of April 2026, and the revisions include replacing disengagement reporting with system-failure reporting and adding monthly and quarterly data submissions. Trucking Dive.

Subscribe to the free newsletter and get market intel delivered straight to your inbox.