The Drayage Dispatch: January 17 - 23, 2025

Drayage & Intermodal Weekly Update Trade policy and network design are colliding in ways that are showing up in lane

Trade policy and network design are colliding in ways that are showing up in lane planning, not just headlines. In November 2025, global container demand rose 7.2% year over year, yet North America imports fell 3.9%, underscoring how tariff posture can redirect flows even when the world is buying more. At the same time, carriers are narrowing port rotations, with Tacoma slated to drop from a key transpacific service in February 2026. Add renewed uncertainty on Asia-Europe routings as at least one major carrier reverts to Cape transits, and the drayage takeaway is familiar: volatility moves inland quickly, and it usually shows up first in appointments and chassis turns.

The European Parliament voted to indefinitely suspend a U.S.-EU trade framework after Trump tied tariff threats to a push to acquire Greenland. The framework would have capped U.S. tariffs on EU imports at 15% while the EU removed levies on U.S. industrial products and offered preferential market access for some U.S. food exports. Supply Chain Dive.

Canada and China agreed to lower tariffs on China-built EVs via a quota system that allows up to 49,000 vehicles annually at a 6.1% most-favored-nation rate, replacing a 100% rate set in 2024. Canada also said the agreement targets broader gains, including reduced tariffs on Canadian canola seed by March 1 and a 50% export increase to China by 2030. Supply Chain Dive.

Data showing North America as the lone region with declining import volumes is now pairing with carrier service adjustments that narrow West Coast port coverage. The combined effect is a market where demand can grow globally while U.S.-bound container activity and port calls soften, changing where dray capacity is needed and when. FreightWaves.

Implication: Drayage providers should expect more uneven gate activity and repositioning pressure as rotations consolidate into fewer California gateways.

A high-profile return to the Red Sea is proving reversible, with at least one major carrier diverting key Asia services back around the Cape of Good Hope. That shift lengthens voyages and reintroduces schedule uncertainty that can ripple into U.S. import arrival patterns and downstream dray planning. FreightWaves.

Implication: Longer, less predictable ocean lead times can compress drayage execution windows and raise detention and storage exposure around peak discharge days.

South Carolina’s Inland Port Dillon reported its busiest year on record, driven by retail growth and agricultural exports, highlighting the continued role of inland rail nodes in reshaping freight flows. The update also points to how inland connectivity can change where containers are transloaded and staged. Maritime Professional.

Implication: More inland rail activity can shift dray demand toward regional ramps and distribution nodes, changing both lane mix and empty return patterns.

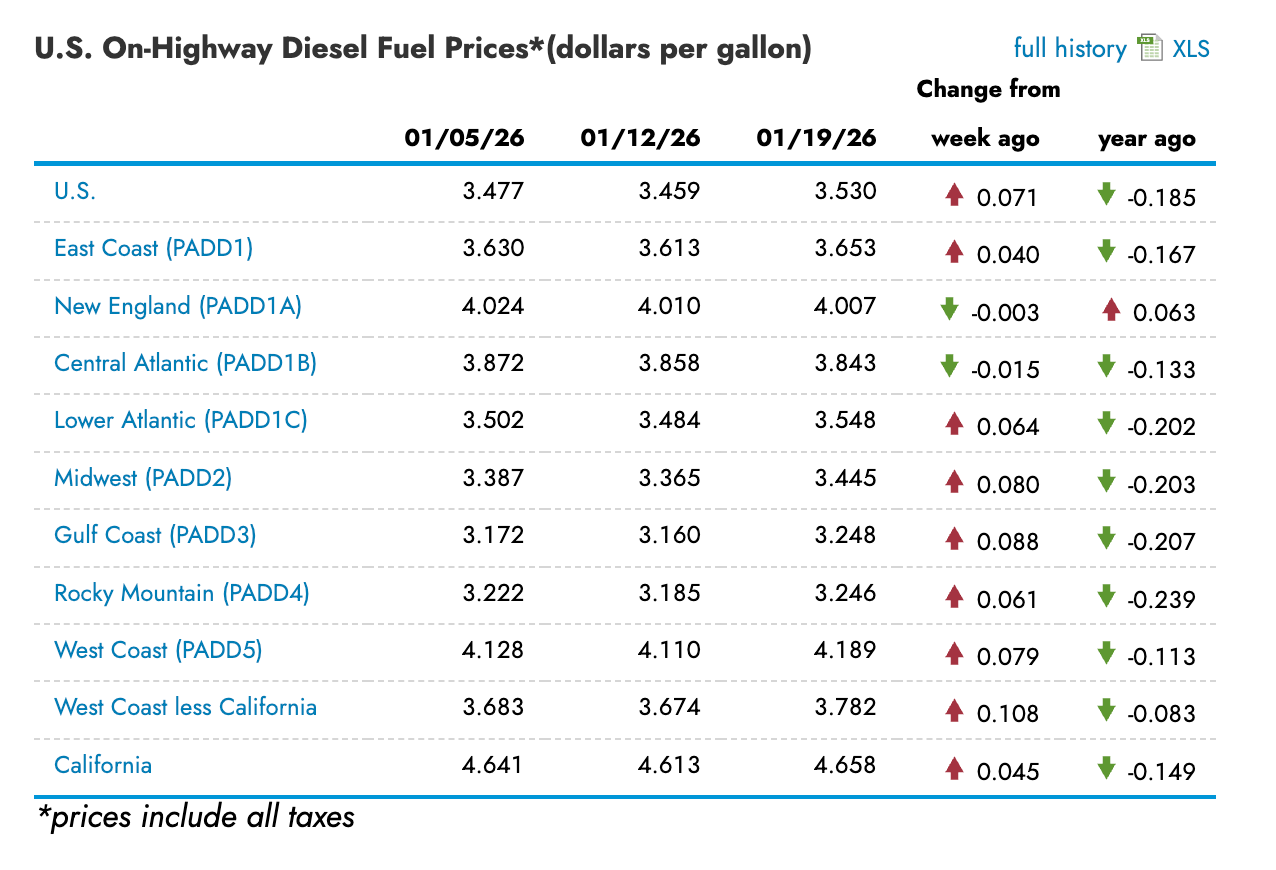

Source: EIA Gasoline and Diesel Fuel Update

Echo’s planned acquisition of ITS Logistics would create a larger 3PL footprint with trailer pool and drop-trailer capabilities more central to the combined offering. The deal is expected to close in the first half of 2026 and is described as creating a business with 2025 pro forma revenue of about $5.4 billion. ITS would continue operating with its existing leadership, while Echo’s technology platform is positioned as a lever for faster response and improved optimization across trailer pools and dedicated operations. Trucking Dive.

CSX’s Q4 earnings article could not be accessed due to a site permission error, limiting what can be summarized from that source. If you paste the article text (or a screenshot), I can slot it into this section in the required two-to-three sentence format with the single TT News link. TT News.

Subscribe to the free newsletter and get market intel delivered straight to your inbox.