The Drayage Dispatch: July 11 - July 18, 2025

Drayage & Intermodal Weekly Update

Containerized trade continues to whipsaw between short-term spikes and long-term uncertainty. This week, ocean volumes rebounded modestly in July, but the recovery is clouded by political crosswinds—particularly the White House's expanding tariff posture. Railroads and carriers are adjusting too: Union Pacific is exploring merger scenarios, and J.B. Hunt is bracing for prolonged demand stagnation despite early surcharge moves. From the ports of Long Beach and L.A. to inland terminals, the industry is watching the tariff clock and rethinking strategy as rate pressure persists.

Headlines & Key Takeaways

Import Volumes to Rebound in July, But Uncertainty Lingers U.S. ports are poised to see an 11% rise in container imports in July as shippers front-load goods ahead of August tariffs. However, forecasts suggest volumes could drop again in Q4 if tariffs are fully enacted, reflecting the underlying instability in trade flows. Supply Chain Dive

J.B. Hunt Warns of Soft Market and Trade-Driven Cost Pressures J.B. Hunt reported flat Q2 earnings and highlighted growing cost pressure from early peak-season surcharges and tariff-linked demand shifts. Executives noted a continued imbalance between pricing and demand, warning that real recovery may not arrive until late Q4. Trucking Dive

Union Pacific Seeks Merger Guidance Amid Strategic Uncertainty Union Pacific has tapped an investment advisory firm to evaluate strategic options, including potential mergers or operational restructuring. While the move doesn’t confirm any specific deal, it signals growing pressure on railroads to consolidate or streamline amid freight downturns. Trains.com

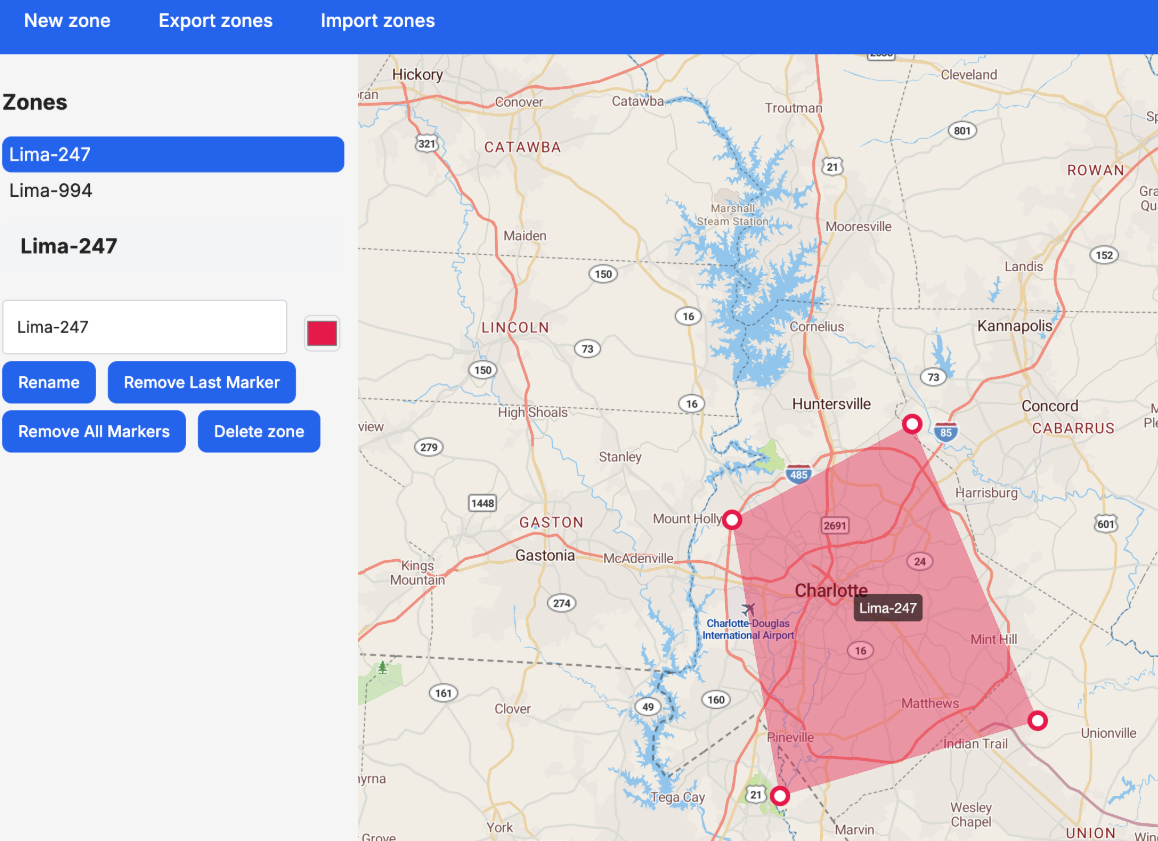

Draw Zones. Get Accurate Drayage Quotes.

Manual quoting is messy—and error-prone. Dray Insight simplifies the process with a visual pricing engine: just draw your zones on the map, and the system instantly calculates precise, margin-aware rates for every lane.

No more guesswork. No more spreadsheets.

Your pricing...Automated.

Brought to you by Dray Insight—smart quoting for intermodal carriers.

Deep Dive: Drayage Market Shifts & Policy Updates

Tariff Rush vs. Volume Drop: West Coast Ports Brace for Whiplash

- Port of Long Beach saw a 21.1% year-over-year cargo drop in June, its lowest level since the pandemic recovery, despite a mild uptick from May.

- Officials anticipate a bounce back in July driven by shippers racing ahead of tariff hikes scheduled for August.

- Imports from China remain volatile, underscoring the tariff-sensitive nature of current flows.

- The port expects an “artificial” volume rise in July that may vanish once policy deadlines hit. Long Beach Post

LA Port Imports Surge as Tariff Countdown Begins

- Port of Los Angeles reported a 13% volume increase in June, driven by retailers accelerating orders before new tariffs.

- Container terminals handled over 825,000 TEUs, with the highest concentration of growth in loaded imports.

- Executive Director Gene Seroka warned the rise was “not sustainable,” calling it a “temporary tariff rush.” SupplyChain247

J.B. Hunt Still Waiting for a Turnaround

- Intermodal and truckload volumes remain below expectations, and revenue per load continues to lag.

- The company emphasized long-term strength in its dedicated segment but sees no near-term catalyst in spot or contract pricing.

- Executives remain cautious about adding capacity, citing an unclear market bottom. FreightWaves

Trade War Expands: Tariff Threats Hit Global Scope

- President Trump confirmed new tariffs set to begin August 1 on imports from the EU, Mexico, Brazil, and Canada.

- The announcement triggered immediate pushback from allied nations, raising the risk of retaliatory measures and supply chain disruption.

- Officials say exemptions for certain sectors may be negotiated, but the list of affected goods is broad and politically sensitive. Trucking Dive

Indonesia Avoids Tariffs With Strategic Trade Deal

- The U.S. reached a bilateral agreement with Indonesia, securing tariff exemptions in exchange for commitments on critical minerals and supply chain alignment.

- The move may provide a model for future tariff carve-outs with strategic partners.

- Logistics firms with exposure to Southeast Asia could benefit from reduced cost volatility and clearer customs paths. Supply Chain Dive

Fuel & Market Data

Source: EIA Gasoline and Diesel Fuel Update

Industry News & Technology Roundup

Daimler Truck will lay off 450 workers at its Gastonia, NC components plant due to reduced demand for Class 8 trucks. Transport Topics

ArcBest CEO Judy McReynolds will retire in October; COO Seth Runser has been promoted to CEO as part of a planned succession. Trucking Dive

Saddle Creek Logistics is listed as the top unsecured creditor in Del Monte’s bankruptcy filing, reflecting rising financial strain on vertically integrated shippers. Trucking Dive