The Drayage Dispatch: July 25 - August 1, 2025

Drayage & Intermodal Weekly Update

The proposed merger of Union Pacific and Norfolk Southern marks the most significant reshaping of American rail in a generation. By linking the country’s two coasts under a single freight network, the deal promises faster transit times, greater intermodal efficiency, and expanded inland access for top-tier container ports. Support from major shippers has been swift. Opposition from rail unions, no less so. Regulators at the STB now face a high-stakes decision: greenlight a new era of transcontinental freight—or hit the brakes.

On trade, the tone is unmistakably sharper. President Trump allowed key tariff exemptions to lapse on August 1, including the de minimis threshold that long shielded low-value imports. The result: higher costs for wholesalers, fresh inflationary pressure for consumers, and a rising risk of retaliation abroad. Patchwork deals with South Korea and the European Union have bought some goodwill but little relief. Global supply chains are entering autumn with more uncertainty than momentum.

Headlines & Key Takeaways

Union Pacific and Norfolk Southern merge, forming the first U.S. transcontinental railroad.

The landmark deal will link East and West Coast routes under one network, with promises of faster coast-to-coast service and expanded intermodal capacity. While shippers and port authorities are largely supportive, rail labor unions have voiced strong opposition, citing job security concerns. Antitrust and STB reviews are expected to intensify in the months ahead. Fox Business

Trump tariffs take full effect August 1, ending key exemptions.

President Trump allowed the exemption window to expire, raising tariffs on a wide swath of consumer and industrial imports. Wholesalers and retailers are already warning of sharp price increases in Q4, particularly for electronics and home goods. The move is seen as politically calculated ahead of the fall campaign cycle, but it has triggered retaliatory discussions across Asia. Reuters

EU–U.S. trade deal offers narrow relief amid broader tariff escalation.

While the agreement removes tariffs on specific high-tech components and green energy inputs, most manufacturing categories remain heavily taxed. European leaders framed the deal as a limited win, securing carve-outs without giving in on broader tariff demands. American exporters welcomed the easing on select automotive and aerospace components. The Guardian

U.S.–South Korea announce a 15% bilateral tariff cap in new agreement.

A fresh deal between Washington and Seoul introduces a cap on reciprocal tariffs, aiming to stabilize regional sourcing routes. The agreement was reached just ahead of the August 1 tariff deadline and is expected to protect Korean automotive and semiconductor exports. It may also set a template for future Asia-Pacific negotiations. Supply Chain Dive

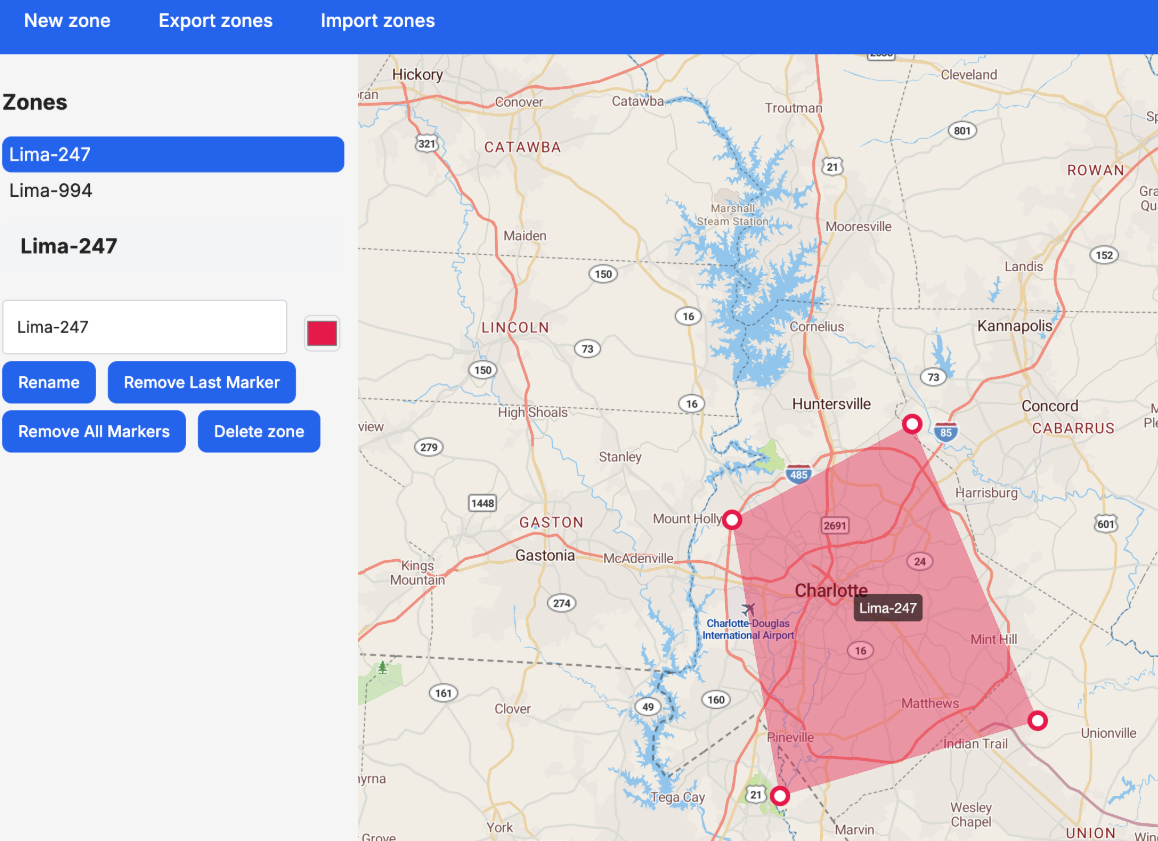

Map Your Rates. Win More Loads.

With Dray Insight, you define your pricing zones on a map once, and our quoting engine does the rest. Every lane, every customer, calculated instantly. Fuel, accessorials, margins—baked in and always accurate.

No more digging through tabs or second-guessing your dispatch team.

No more quoting by feel.

Just fast, clean, confident pricing.

Built for the way drayage actually works.

Deep Dive: Drayage Market Shifts & Policy Updates

The UP–NS Merger

- Market Access: The merger will unlock seamless rail access from LA/Long Beach to the East Coast, enhancing inland reach for the nation’s top container ports. Shippers are expected to benefit from improved transcontinental service times and lower interchange complexity.

- Labor Response: Major rail unions have signaled opposition, warning of job cuts and urging regulators to scrutinize consolidation risks. Worker strikes or slowdowns remain a possibility.

- Industry Support: Hub Group and other major intermodal players have endorsed the merger, citing long-term infrastructure benefits and better service integration.

- Competitive Implications: CSX, reportedly in talks with Goldman Sachs for asset divestitures, may feel pressure to respond to the scale of the new UP-NS network.

Sources: FreightWaves, CNBC, FreightWaves, TT News

Trump Tariffs and the End of De Minimis

- Exemption Eliminated: The long-standing de minimis rule that exempted low-value shipments from tariffs has been repealed. This is expected to drive a sharp increase in containerized cross-border shipments, especially from Mexico and Canada.

- Wholesale Price Pressure: Distributors report a 7–12% spike in costs across consumer electronics, apparel, and industrial supplies as August 1 tariffs take effect.

- Retailers React: Many wholesalers are front-loading inventory, but some admit the cost increases will inevitably hit end consumers by Q4.

- Policy Momentum: The administration has hinted that similar rules may be revised in other trade corridors as part of a broader push to repatriate supply chains.

Sources: CNBC, TT News, Supply Chain Dive

Fuel & Market Data

Source: EIA Gasoline and Diesel Fuel Update

Industry News & Technology Roundup

GHG3 trucking emissions rule voided by federal court. A federal judge overturned the GHG Phase 3 emissions mandate, citing overreach and insufficient industry consultation. The ruling was welcomed by small carriers and truck manufacturers. Transport Topics

Carroll Fulmer shuts down after 71 years. The Florida-based carrier announced an immediate closure, citing market volatility and driver shortages. Customers and vendors were given one week’s notice to wind down operations. Mid Florida Newspapers