Turning RFQ Wins Into Profitable, Sustainable Drayage Operations

Winning a drayage RFQ feels like a win—but it’s really just the starting line. But winning lanes and securing profitable drayage rates depends on what you do next. It’s your chance to prove you belong and position yourself for something bigger.

Most carriers treat onboarding like paperwork because they think the work starts when the first container moves. That’s why they lose business. The real work is aligning processes before the first dispatch.

That’s short-term thinking.

If you’re serious about growing your business, the real work starts now.

Here’s how smart carriers turn a few awarded lanes into a sustainable, profitable operation—and stay first in line when more business comes up.

1. Nail Your Drayage RFQ Onboarding—And Take Control Early

For most carriers, onboarding is paperwork: rate confirmations, EDI setup, dispatch contacts.

Smart carriers treat onboarding like the first move in a long game. Nail it, and you’re not just a vendor—you’re the partner they rely on when things get messy.

Start with a kickoff meeting. Bring in ops, procurement, leadership—and ask your customer to do the same.

Set the expectations:

- Share your plan: include dispatch plan, front line contact (including name, email, phone), escalation paths, billing processes.

Get their SOPs—especially:

- Operations & internal team handoffs

- Communication protocols

- Billing, rate confirmations, dispute resolution

- Accessorial policies (who, when, how, why)

Now do what most carriers skip: compare their SOPs to yours.

- Where do the processes misalign?

- Flag the gaps before they become fires.

Wrap it up into a welcome packet: contacts, escalation paths, billing steps, SLAs, expectations—everything documented and shared.

Why this matters: Alignment now prevents friction later. You become the carrier who’s easy to work with. And easy to grow with.

2. Map Stakeholders Early—And Manage Them Differently

Most carriers zero in on ops and miss the bigger picture.

Procurement controls contracts. Finance controls cash. Execs control strategy.

Talk to all three—or risk getting sidelined.

Map out who’s who:

- Ops managers (control volume)

- Procurement leads (control RFQs)

- Finance (control payments/disputes)

- Executives (control the future)

Tailor how you talk to each:

- Procurement gets SLA scorecards and cost breakdowns.

- Ops gets day-to-day performance updates.

- Execs get big-picture visibility—risk mitigation, cost predictability, capacity stability.

Remember to identify people by name and not just an inbox. This will help you build a better relationship and give you a better understanding of who to contact when necessary.

Why this matters: When it’s time to renew or expand, you won’t be a name on a spreadsheet—you’ll be the partner everyone already trusts. Here's a guide to stakeholder mapping from ProjectManagement.com that nails this point.

Want help building an RFQ strategy that wins—and scales?

3. Stress-Test Communication Before the Fire Drill

Processes always look good—until something breaks.

Picture this: It’s Friday at 4 PM. Because it’s always Friday at 4 PM for the biggest headaches. The container wasn’t picked up on time. It’s a military shipment. The customer can’t reach dispatch and needs the shipment today.

Are you reacting on the fly, or calmly following a plan you trust?

Run 1-2 practice drills after onboarding:

- Simulate a delayed container scenario

- Walk through a billing dispute resolution

- Test an escalation process

Spot where communication breaks. Fix it before it matters.

Want to impress your customer? After each drill, document what worked, what didn’t, and what’s next. Share the results and improvements with your customer—they’ll appreciate the transparency and trust you more for it.

Why this matters: You reduce risk and prove you think ahead. Harvard Business Review backs it—strong communication builds trust before crisis.

4. Build a Crawl-Walk-Run Phase

Don’t promise perfect. Promise progress—and show it.

Don’t promise perfect. Promise progress—and prove it.

Lay out a phased approach:

Crawl (First 7-14 days):

- Weekly check-ins

- Real-time issue tracking

- Fix root causes fast

Walk (Next 15-45 days):

- Bi-weekly or monthly review

- Share KPI trends

- Document and share improvements

Run (45+ days):

- Shift to quarterly reviews

- Focus on advising, not just reporting

Bonus: After 30 days, send a short feedback survey:

- What’s working well?

- Where can we improve?

Why this matters: Early feedback keeps customers invested. You stay in control of the narrative. HubSpot’s customer success resources can help drive early and build long-term loyalty.

5. Understand Their Business Goals—Not Just Their Lanes

You’re moving freight. But do you know why it matters to them? How are you helping your customer deliver for their customer, the shipper?

Smart carriers ask:

- Are they prioritizing cost control, capacity stability, or growth?

- How do they measure success—on-time %, cost per load, or service reliability?

Once you know, align your reporting, performance reviews, and improvements to hit their goals—not just yours. When they win, you win too.

And don’t assume their priorities stay the same—ask again every quarter. Business pressures shift fast, especially in volatile markets. Staying in sync means you’re always positioned as the partner helping them hit their targets, not just filling trucks.

Why this matters: You shift from vendor to partner. You’re helping them win internally and with their customers, meaning more business opportunities in the future. That’s how you make yourself essential when the next budget or bid cycle comes around.

6. Communicate Like You’re the Easiest Carrier to Work With

If they have to ask where things stand, you’re already behind.

Assign one accountable contact and double-check your customer knows who it is. Share clear escalation paths. Send weekly updates early on:

- Wins

- Exceptions

- Improvements

But don’t stop at updates—make communication a competitive advantage. The goal isn’t just transparency; it’s to become the carrier they trust most to surface issues before they snowball. Set the tone by being the first to flag small problems, offer solutions, and share insights about what’s happening in the market.

The reality is, your customer has dozens of carriers. Most only reach out when there’s a problem. Be the one who reaches out when things are smooth, too. That’s how you stand out—and how you build a relationship.

Most carriers think the ops contact is their champion. But if procurement hasn’t heard from you in months, you’re one RFP away from losing volume.

Why this matters: Proactive carriers win more business. No surprises = no reason to shop around. And the more visible and reliable you are, the more indispensable you become. TSIA’s guide hits this perfectly though you may have to download it.

7. Track Customer Health—Not Just Operational KPIs

Most carriers track performance metrics. Smart carriers track people. Great carriers track both—and know how to use them to grow their business.

Most carriers obsess over:

- On-time %

- Billing accuracy

- Accessorial disputes

But do you track relationship health?

- How often are you talking to procurement, finance, execs?

- Are billing disputes piling up—or getting resolved fast?

- Is feedback flowing consistently?

Build a basic customer health dashboard—even if it’s manual. Challenge yourself to learn something personal about your customers as well: what they did last weekend, what their spouse’s or children’s names are, if they have a favorite sport. For a deeper dive, check out Gainsight’s guide to understanding customer health scores.

Why this matters: Healthy relationships = stable margins + room to expand. Spot churn risk before it shows up in lost volume. Leverage your relationship to add depth and durability.

8. How to Grow Drayage Business Between RFQ Cycles

Here’s the mistake: Most carriers wait for the next RFQ to ask for more business.

You’re smarter.

Use quarterly reviews to:

- Ask where they’re struggling—capacity gaps, rising costs, risk points.

- Offer solutions—dedicated driver pools, flexible chassis terms, rate model transparency.

- Share insights—market trends, congestion reports, drayage rate shifts.

Why this matters: You control the conversation before procurement even starts planning the next bid cycle.

Stay ahead of drayage market shifts.

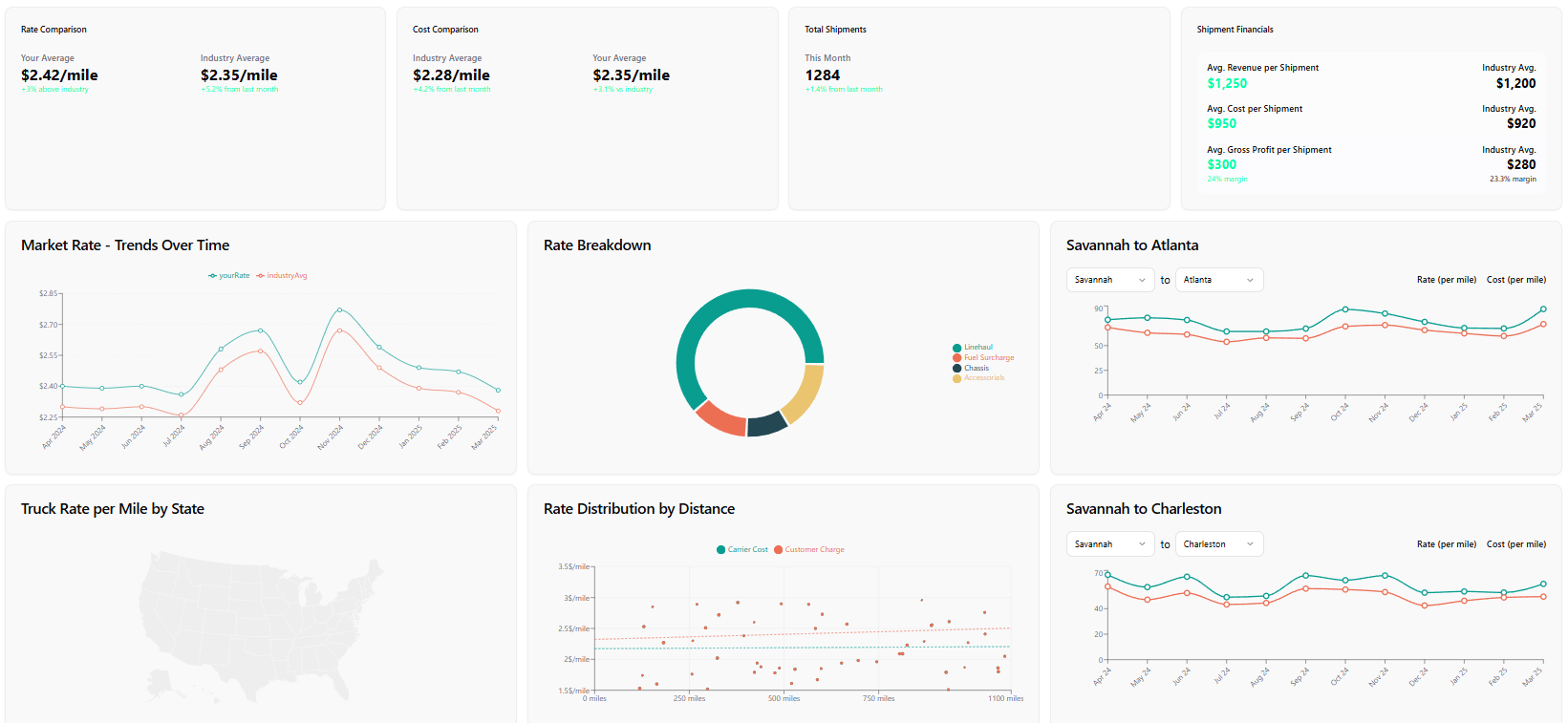

Our soon-to-launch [Market Intelligence Platform] gives you real-time insights into spot rates, capacity trends, and congestion—all in one place.

9. Customer Success = More Volume, Faster Payments, and First Dibs on New Business

RFQs don’t build loyalty. Operations do.

The carriers who master customer success—tight onboarding, stakeholder alignment, proactive communications, continuous improvement—don’t just keep the business. They grow it.

Customer success is how you turn solid service into growing volume, smooth payments, and more business without waiting for the next RFQ.

Want more volume? Be the carrier they know won’t miss a beat when they need extra capacity.

Receivables getting stuck with offshore finance teams? Build strong processes upfront—clean billing, clear contacts, proactive follow-ups—so payments flow without friction.

Want first crack at new lanes or projects? Make sure procurement and ops know you’re solving problems before they happen, not after.

Customer success isn’t a side task. It’s how you lock in the account, grow the freight, and stay top of mind every time they have more business to award.

Why this matters: Shippers don’t hand out loyalty—they hand out freight. Every extra container, faster payment, and new lane opportunity goes to the carrier making their life easier. Master customer success, and you don’t have to wait for the next RFQ to grow. You’re already first in line.

10. Protecting Your Drayage Rates After the RFQ Win

Winning an RFQ means your drayage rates are locked in—but the work doesn’t stop there.

Market conditions shift. Costs change. If you don’t monitor your drayage rates post-award, rising costs can silently erode your margins.

Smart carriers regularly review:

- Are fuel, chassis, or driver costs impacting my profitability?

- Do my accessorials and billing terms still reflect my true costs?

- How can I adjust or renegotiate drayage rates before renewal periods?

Keeping a close eye on your rates isn’t just about profitability—it’s about showing procurement and finance teams you’re proactive, stable, and reliable long-term.

Protect Your Drayage Margins—Before the Market Shifts

Use our Rate Quoting App and Market Intelligence Platform to monitor rates, control costs, and lock in profitable drayage moves.

- Track spot drayage rates & market trends

- See true shipment costs at a glance

- Adjust rates before rising costs cut profits

Final Thoughts:

Winning the RFQ isn’t the goal. It’s the opening move.

Treat onboarding, stakeholder management, and reviews like your growth engine—not admin work. That’s how you grow volumes, earn loyalty, and become the carrier they can’t afford to lose.

Remember carriers who wait for the next RFQ are playing checkers. Smart carriers use customer success to play chess.

Frequently Asked Questions About Drayage Rates

What is a drayage rate? A drayage rate is the cost charged for transporting shipping containers over short distances, typically from a port or rail yard to a warehouse. It includes driver costs, fuel, chassis fees, and accessorial charges.

How do you calculate a drayage rate? Drayage rates are calculated based on factors like mileage, driver costs, chassis fees, fuel surcharges, and overhead costs. Many carriers use either a flat per-load model or mileage-based rate, adjusted for specific accessorials or operational constraints.

How does winning an RFQ affect your drayage rates? Winning an RFQ sets contracted rates for certain lanes, but regularly reviewing and recalculating drayage rates ensures you stay profitable as costs change.

What are normal drayage rates in my area?

Drayage rates vary by region, fuel costs, chassis availability, and terminal conditions. You can view a basic dashboard from the Market Intelligence Platform showing typical spot drayage rates in your area. Rates are updated once per week to reflect market shifts.